FTX, another crypto unicorn bites the dust

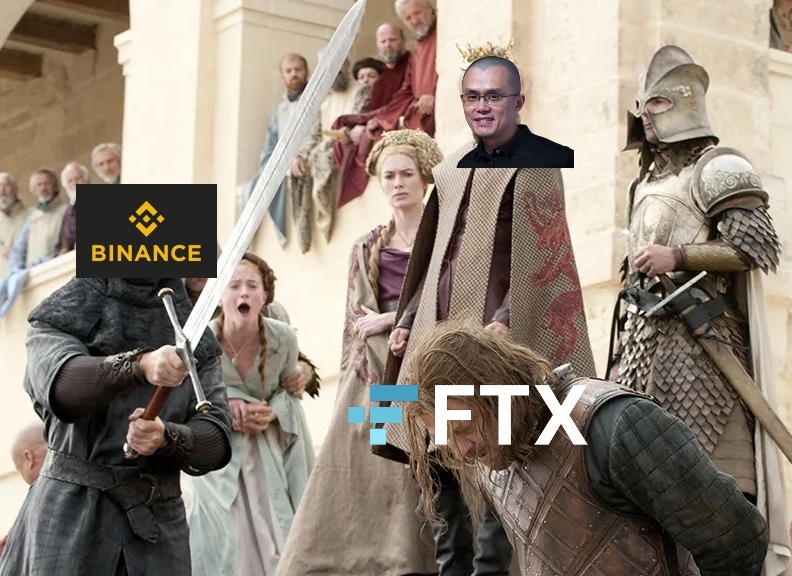

Old-school financial malpractices, conflicts of interest and a Game-of-Thrones-style payback. Here is your future favourite Netflix documentary! 👀

1. How did it all start?

FTX starts up in 2019. They are coming very late to the crypto exchange game. They still manage to raise money from Binance. Good for them. 👍

However, when they became a serious competitor, Binance wanted to cash out of their investment. It’s a conflict of interest, it’s common business sense. 👌

But how can FTX find the cash to buy back their shares from Binance? In the crypto world, it’s actually pretty easy. You create your own currency/coin and you start printing virtual money. Binance gets $2bn worth of FTT (FTX’s “coin”). 🤔

2. Alchemy by FTX

FTT has only one very limited purpose: you can pay the exchange fees with it. It’s like buying a gift card to pay for groceries every day. You could do that, but it’s stupid so people use money directly. 😒

Now, how do you maintain the value of a coin that has no value/utility/purpose?

Easy, you set up a hedge fund (that you kind of own). Let’s call it something nonsensical like Alameda Research. This fund will borrow real dollars and buy up your useless coin to prop up its value. While the value of your FTT coin rises, you get richer. But if it drops under a certain level, you’re dead.

3. Winter is coming

The crypto winter is here. FTX has amassed a lot of virtual fortune, their competition is dying off.

Genius idea💡1 : FTX uses up their “fortunes” to buy up assets from dying competitors. More leverage, more pressure to keep up the coin propped up.

Genius idea💡2 : Since every penny counts, let’s use our own coins and our customers’ coins to borrow even more money. That way we can prop up our coin throughout the crypto winter.

Naturally, when you have genius ideas like that, you get cocky and start plotting against other crypto CEOs.

CZ — the CEO of Binance, an early benefactor of FTX, the only crypto exchange multiple times bigger than FTX, father of crypto dragons — is pissed… You have woken up the white walker king.

4. The white walkers come and bite off your head

The balance sheet of Alameda Research (the hedge fund from earlier) is leaked… Oops. Now, everyone knows what’s up with the FTT business model. CZ of Binance definitely knows what’s up.

A tweet from CZ outlines that Binance intends to sell its $2bn worth of FTT. That’s a very very big chuck of an illiquid crypto.

People panic, people sell, FTT crashes all the way. We are well past the “certain level” required for Alameda to default. Margin call! 🔔

And now, people fear for their crypto and start withdrawing it from FTX. Classic bank run. 😉

Without its market maker, FTX lacks liquidity. They stop processing customer withdrawals.

Who’s the only exchange big enough to save you? … ah

5. Season finale

That part is still in the making.

So far, Binance has signed a non-binding LOI. So they agreed to think about maybe having a look at perhaps saving some bits of FTX.

One thing is clear: Binance started as a minority investor and can now handpick what they like for free.

The CEO of FTX begs CZ (of Binance) for mercy on Twitter.

Like Ned Stark, you are

asked to beg publicly for your life.

(🚨Spoiler alert) Your head gets chopped

off anyway.

CZ is a shark like we haven’t seen in a long time in “regular” finance. He’s shown once more that power is power! 😉